Worst Medicare Supplement Companies

Choosing a Medicare Supplement plan (Medigap) looks like navigating a minefield. You’re promised peace of thoughts, however the actuality is usually a battlefield of complicated insurance policies, hidden charges, and poor customer support. This article sheds gentle on the right way to establish the worst Medicare complement corporations, serving to you keep away from pricey errors and safe the protection you deserve. We’ll discover frequent pitfalls and empower you to make knowledgeable choices, making certain your golden years are really golden.

Contents

Decoding the Deception: Four Tactics of the Worst Medicare Supplement Companies

The insurance coverage business, whereas essential, is not at all times clear. Some corporations prioritize revenue over buyer satisfaction, using ways that may go away you excessive and dry whenever you want them most. Let’s look at 4 methods typically utilized by the worst Medicare complement corporations:

Source: norton.com

1. Hidden Fees and Fine Print: The Sneaky Surprise, Worst medicare complement corporations

Many worst Medicare complement corporations bury essential data inside prolonged, advanced contracts. These hidden charges, like exorbitant administrative costs or sudden exclusions, can considerably enhance your out-of-pocket prices. Think of it as a Trojan horse – seemingly reasonably priced premiums hiding a pricey shock inside.

Example: Imagine Company X promoting a low premium however failing to reveal a $500 annual administrative payment, not talked about till the coverage is issued. This drastically alters the cost-effectiveness in comparison with a competitor with clear pricing.

Navigating the advanced panorama of Medicare complement plans typically reveals a stark actuality: some corporations persistently underperform. Consumer stories often spotlight discrepancies in declare processing speeds and protection limitations, main many to hunt alternate options. For entrepreneurs seeking to capitalize on this want, maybe a associated alternative exists, resembling buying a healthcare consulting agency among the many business for sale in Louisiana , which may focus on serving to seniors navigate the intricacies of selecting a dependable Medicare complement supplier.

This would handle the market want for dependable details about the worst Medicare complement corporations and supply precious companies to a susceptible inhabitants.

Actionable Step: Carefully overview all the coverage doc, together with the wonderful print. Don’t hesitate to contact the corporate instantly and ask clarifying questions on any unclear phrases or charges. Compare a number of quotes side-by-side, paying shut consideration to all charges and costs.

2. Poor Customer Service: Leaving You within the Lurch

When you need assistance navigating claims or understanding your protection, you want responsive, useful customer support. The worst Medicare complement corporations typically fail to ship, leaving policyholders pissed off and struggling to entry the care they want.

Example: Company Y might need lengthy wait instances for telephone assist, unresponsive e-mail inquiries, and a convoluted claims course of. Imagine making an attempt to get a vital declare processed whereas coping with a well being disaster – a nightmare state of affairs.

Actionable Step: Check on-line critiques and rankings from websites just like the Google search results for Medicare supplement company reviews or the Better Business Bureau. Look for constant patterns of complaints concerning customer support responsiveness and effectivity.

3. Limited Network of Providers: Restricted Access to Care

Some worst Medicare complement corporations have restricted networks of collaborating medical doctors and hospitals. This can severely prohibit your selections, forcing you to journey additional or settle for much less fascinating care.

Example: Company Z would possibly solely cowl a small variety of specialists inside your space, that means you would face lengthy ready lists or be pressured to see suppliers exterior your most popular community.

Actionable Step: Before signing up, affirm the corporate’s supplier community. Check in case your most popular medical doctors and hospitals are included. If you could have particular healthcare wants, make sure the plan adequately covers these suppliers.

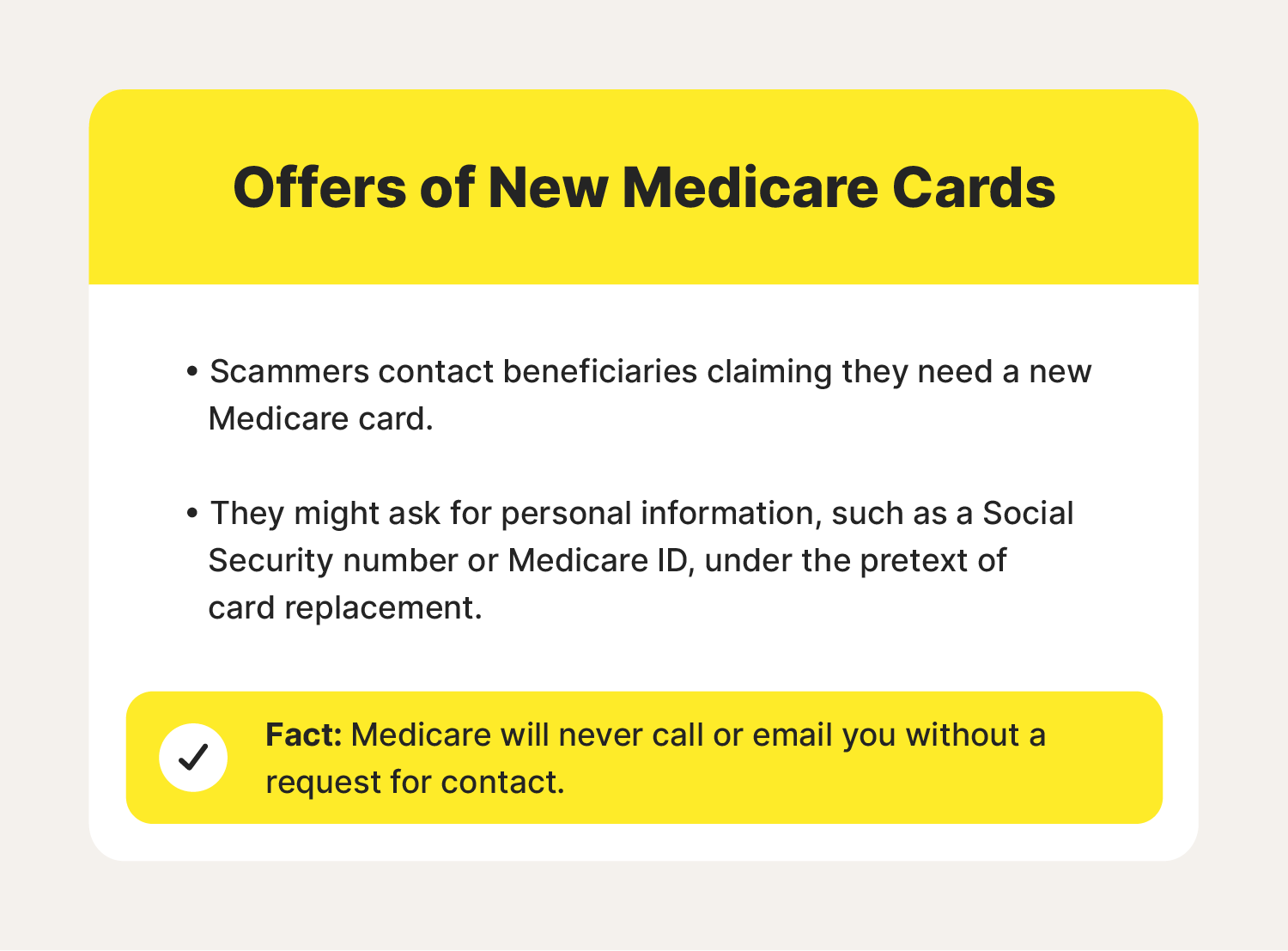

4. Aggressive Sales Tactics: High-Pressure Selling

Be cautious of corporations using high-pressure gross sales ways. These can vary from deceptive promoting to aggressive telephone calls, creating an surroundings the place knowledgeable decision-making is troublesome.

Example: An organization would possibly exaggerate the advantages of their plan or downplay potential drawbacks, pressuring you into a fast resolution with out ample time to analysis alternate options.

Actionable Step: Take your time. Don’t really feel pressured to decide instantly. Compare a number of plans from completely different corporations, and search recommendation from impartial insurance coverage advisors. Never really feel obligated to purchase a plan in the event you’re uncomfortable with the gross sales course of.

Source: ez.insure

Summary and Call to Action

Identifying the worst Medicare complement corporations requires vigilance and cautious analysis. By understanding their ways – hidden charges, poor customer support, restricted networks, and aggressive gross sales – you’ll be able to defend your self and safe the very best protection. Share your experiences and ask questions within the feedback under – let’s construct a group to assist everybody navigate this vital resolution.